Prime Minister Justin Trudeau announced the details for the Canada Emergency Commercial Rent Assistance (CECRA) program on April 24, 2020. The program aims to provide the support needed by small businesses experiencing financial hardship due to the COVID-19 outbreak. The government hopes that introducing this program will contribute towards a quicker and easier economic rebound once restrictions are lifted. In order to do this, the CECRA will offer forgivable loans to eligible commercial property owners. As a result, small businesses will be relieved from 75% of the amount of rent owed.

The Canada Mortgage and Housing Corporation (CMHC) is the Crown Corporation responsible for administering the CECRA. For a more detailed description of the CECRA, please visit the following link.

What is the CECRA?

This program offers assistance to both small business tenants and commercial property owners for the 3-month period of April, May, and June 2020. Note that the CECRA can be applied retroactively. However, be mindful of the August 31, 2020 application deadline.

As mentioned above, the CMHC will provide forgivable loans to eligible commercial property owners. The CECRA requires that the rent forgiveness agreements include the following terms:

- The loans will account for 50% of the gross rent owed.

- The commercial property owner will be responsible for 25% of the remaining payments.

- The small business tenant will be responsible for 25% of the remaining payments.

Who Qualifies?

The CECRA eligibility requirements for property owners include:

- Owning Canadian commercial property that gains rental revenue from an impacted small business.

- Declaring rental income on your tax return for 2018 and/or 2019.

- Agreeing to reduce the impacted small business tenant’s rent by 75% for the 3-month period.

- Including a term on the rent reduction agreement to not evict the impacted tenant during the 3-month period.

What is an impacted small business tenant?

The term ‘impacted small business tenant’ has been thrown around throughout this post. What exactly does it mean? The CMHC has defined it as businesses, including non-profit and charitable organizations, who:

- Pay less than $50,000 in rent;

- Have temporarily ceased operations or experienced a 70% drop from pre-COVID-19 revenues; and

- Produce less than $20 million in gross revenues.

How Can You Apply?

The application for the CECRA is not yet available, but it will be in place by mid-May. Thus, retroactive relief will be provided for the months of April and May.

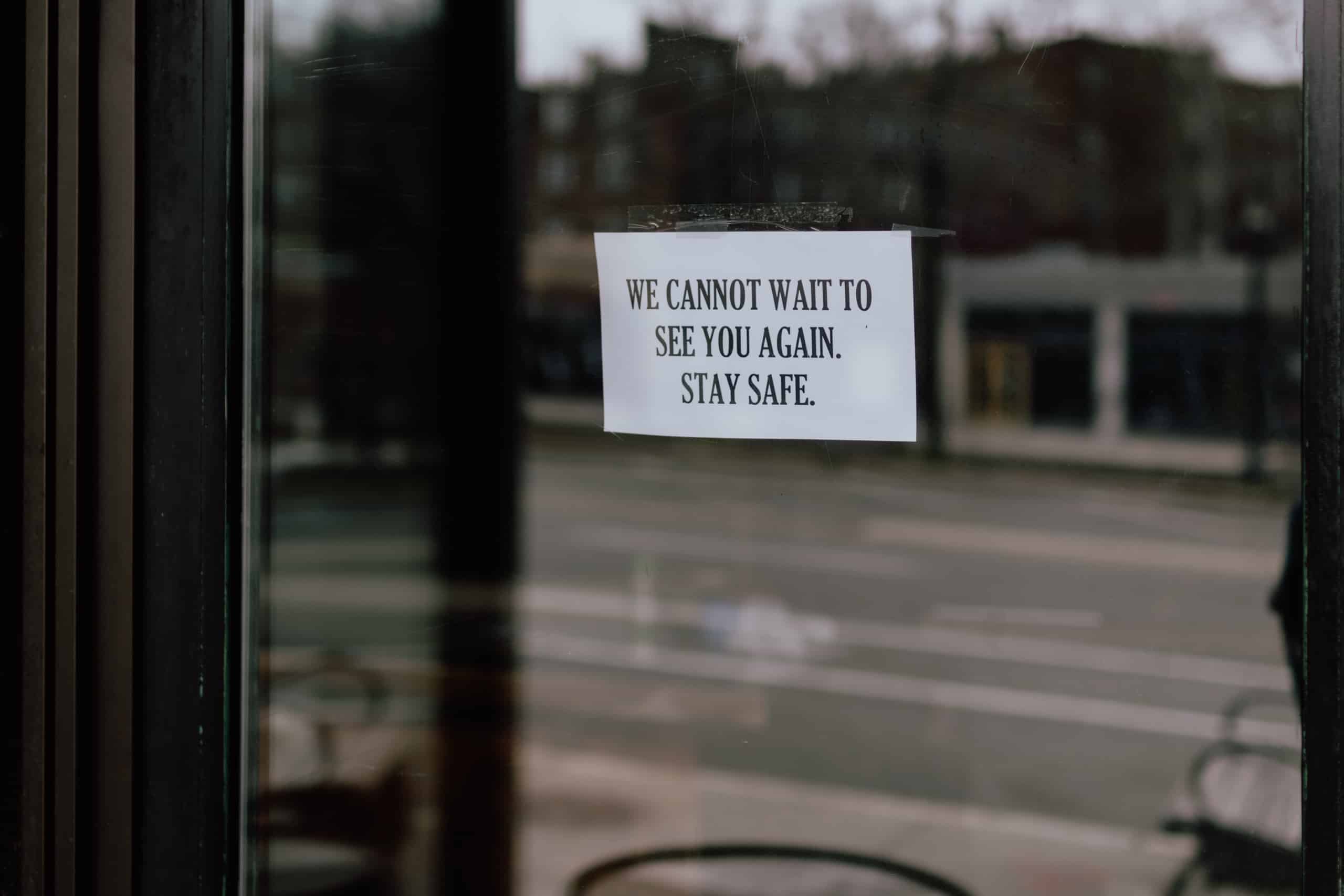

We understand that these are troubling and unprecedented times. The team at Sodagar & Co. is determined to monitor developments and any updates regarding COVID-19 policies. We are here to assist commercial property owners and small business tenants in navigating the CECRA. Should you require more information or guidance with overcoming obstacles presented by COVID-19, our Firm has the means to service you remotely.